By Mathew Keller, RN JD

Regulatory and Policy Nursing Specialist

Regulatory and Policy Nursing Specialist

We’ve detailed at length the connections between Piper Jaffray and Allina. Piper Jaffray, as you recall, served as a broker/dealer to a 2007 “Auction Rate Security” bond offering that ultimately led Allina to sue. Allina claimed that the other broker-dealer (UBS) knew the Auction Rate Security market would fail mere months after the bond offering, but, interestingly, Allina did not make that claim against Piper. This transaction caused Allina to lose tens of millions of dollars in penalty interest rates, interest rate swaps, and early termination fees when it refinanced the bonds. Piper Jaffray was well represented on Allina’s Board of Directors throughout the 2007 bond offering and Allina’s lawsuit against the other broker-dealer (but not Piper).

When Allina refinanced its 2007 bonds, US Bank benefitted immensely. US Bank and Piper Jaffray have strong ties going back to 1998, when Piper was acquired by US Bank. Piper spun off US Bank in 2003, but the two corporations still do brisk business together. Until now, though, we’ve never had evidence of a direct connection between US Bank and Allina, apart from the presence of US Bank Chief Investment Officer Mark Jordahl on Allina’s Board of Directors.

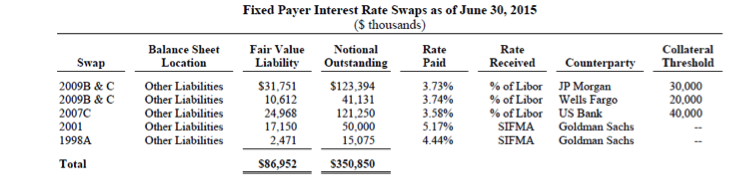

Considering Jordahl’s presence on Allina’s Board, it shouldn’t be surprising that when Allina refinanced its bad 2007c series Piper Jaffray/UBS bonds, it gave $121 million worth of business to US Bank. The refinancing terms on the 2007c US Bank bonds were better than those Allina had with UBS/Piper, but still unfavorable overall. Allina lost $4 million dollars on these loans last year alone.

If Allina were to refinance this debt (again) to save money, it would have to pay US Bank a $25 million termination penalty. As MNA Executive Director Rose Roach put it in a letter to Mark Jordahl requesting a meeting to discuss these loans, “that is money that could be used to better serve Allina patients.”

Roach continued to argue, “we are especially concerned about this situation, given your long tenure on the Allina board [from 2006-2016], and your leadership position as the Vice-chair and Chair from 2012 through 2014.”

The more one looks into Allina’s business dealings, the more conflicts of interest between spending money on patient care and throwing money at big banks emerge. Given these ongoing discoveries of conflicts of interest between big business and patient care, shouldn’t we all be concerned?